Here is a great post from education.com when it comes to multiplication and helping your kids count money.

Enjoy!

=======================================================================

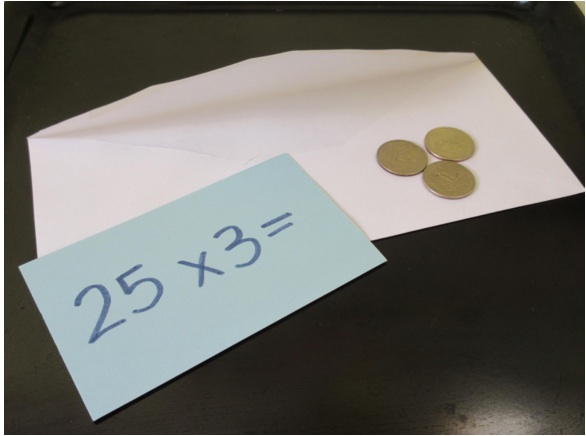

Typically, the way children practice multiplication is by looking at equation cards and answering from memory. With this challenge, your child will be able to use objects to practice multiplication and counting money. Having tactile materials makes more sense and adds relevancy for children learning new concepts.

What You Need:

- Letter envelopes

- Index cards

- Coins

What You Do:

- Insert multiple coins of the same value into each envelope. Make sure you come up with equations ahead of time, and try them to see if they would make sense to your child.

- Put index cards inside the envelope he can use to practice writing the equations. If you don’t have any index cards on hand, have him write the equation on the envelope.

- Have him pick any envelope and open it. When he takes out the coins, have him tell you the value of that coin type. Then, have him count how many coins he has.

- To begin creating an equation, he will have to multiply the amount of coins he has by the value of the coin. For example, if there are three quarters in the envelope, he needs to multiply 25 x 3.

- Repeat!

By the end of this activity, your child will have a strong grasp of both multiplication and counting money, a useful skill as he sails out into the world.